From Serial Entrepreneur To US Ambassador

Interviewing Trevor Traina: what's the best M&A playbook after selling 5 startups?

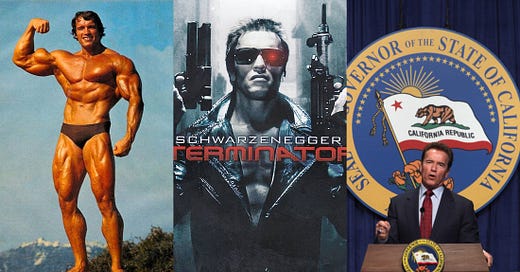

The Arnold Effect - A Mindset for Success

There are certain people who can perform at peak levels in very different disciplines. It’s already unlikely that any given person would reach the top of whatever they decide to focus on—sports, business, or politics, let alone do so in more than one. Think about Arnold Schwarzenegger. In bodybuilding, he won the prestigious Mr. Olympia title a record-setting seven times. Top. He’s considered a legend of the sport. He then decided he wanted to become a Hollywood actor, and well… he did. Arnold became one of the highest-grossing actors of the 80s and 90s, with films like the Terminator saga, Batman & Robin, True Lies, and others. That right there is already an extreme rarity. But Arnold went for more and set his sights on becoming a politician. Sounds crazy? The Austrian-born bodybuilder, turned Hollywood star, turned politician, served two terms as the Governor of California, the most populous state in the US.

Arnold’s latest documentary on Netflix does a pretty good of conveying this go-getter spirit.

The Art Of Selling Startups - M&A, M&A, M&A…

It requires a unique mindset to be able to succeed in many different realms. That’s why we have so few examples. Trevor Traina is one of them. Born into one of the wealthiest families in the US, a descendant of Herbert Henry Dow, founder of Dow Chemical, he didn’t exactly need to put food on the table. However, he went on to start 5 different tech companies and sold them to the likes of Microsoft, Mastercard, and others. I was very intrigued by what kept driving him, and we dig into that during the pod. Not content with his many business successes, Trevor pulled an Arnold and in 2018 was unanimously confirmed by the U.S. Senate as Ambassador to Austria (I know, the comparison works beautifully).

By no means do I want to write a summary of all of the things Trevor and I discussed, so go ahead and tune in or jump to the part you’re most interested in using the timestamps below. I do want to comment on one of the many insights Trevor shared with us, though, on the art of selling businesses. After 5 startups and 5 M&A exits, Trevor knows a thing or two about it and developed a bit of a playbook, which he goes into detail about it in our Sobremesa.

Founders and investors with M&A capabilities and experience dramatically increase the probability of a liquidity event in the future.

This has always been the case, but it’s especially true these days with an IPO window that is practically closed—a far cry from what founders were used to over the last couple of years, right up until 2022.

The other point to be made here is that, regardless of the IPO window, there are many instances where a startup, before being IPO-ready, might be suitable for an exit through M&A. It’s also a good reminder that the vast majority of liquidity events happen well below the unicorn status, as we can see from the likely imprecise, but directionally correct table below:

To reiterate and drive this point home: there aren’t many exits over $100mm.

In this lower range, M&A becomes a particularly handy tool to have. Rex Salisbury shared the chart below with the question “If the IPO window is closed, is the M&A window open?”. The slide by Morgan Stanley shows that there’s enough dry powder from the typical “unicorn hunters” to acquire all of them. But, as we’ve reminded ourselves today, most exits happen at figures below the unicorn status… let’s just say there’s plenty of cash for M&A to be the name of the game in the coming quarters. Smart entrepreneurs, and the investors in their cap table, should be thinking about this more often and always have an eye out for M&A even if this is not the ultimate goal for your startup.

Trevor sold his first company to Microsoft for $100mm and then replicated his formula with 4 additional subsequent exits. Some practical tips distilled from his M&A experience:

Businesses are not sold; they are bought

The best moment to think about M&A is at every single natural inflection point of the company (post-product improvement, before/after a round of financing, etc.)

The best way to approach a sale is through a partnership conversation

Give the appearance of a potential partnership and express the vision of synergies and benefits of working together, so that the other side of the table would think owning you is a must for their future success

Find two, not only one champion, to push the deal internally

One at a very senior level, and another one at the working level

This is just the tip of the iceberg of our conversation. We also talk about how Trevor landed the US Ambassador´s position, his prediction on the upcoming US elections, the impossible debate between market vs founder, his latest company Kresus, and much more.

You can listen now on Spotify, Apple or watch the video below.

In this Sobremesa, we chat about:

(00:00) Coming Next

(00:37) Introducing Trevor Traina

(01:11) Being born into one of the wealthiest families in the US

(03:24) What do the most successful entrepreneurs have in common?

(07:43) The Arnold Effect and the right mindset for success

(09:57) First tech exit: selling to Microsoft for $100mm

(13:54) Impossible debate: What’s more important, the market or the founder?

(17:43) Having sold 5 companies, advice on when is the best time to sell?

(20:00) M&A strategy: what exactly do you need to do if you want to sell?

(23:51) Kresus: Trevor’s latest startup

(26:17) How to navigate a bear market

(29:12) How brands are looking at the crypto space now

(32:12) AI advancements and identity issues

(33:07) How did Trevor become a US ambassador?

(34:37) Achieving top-secret security clearance

(35:10) What’s it like to be a US Ambassador?

(37:12) What can tech learn about politics and vice-versa?

(39:58) Who will be the next US president?

(41:38) Closing remarks