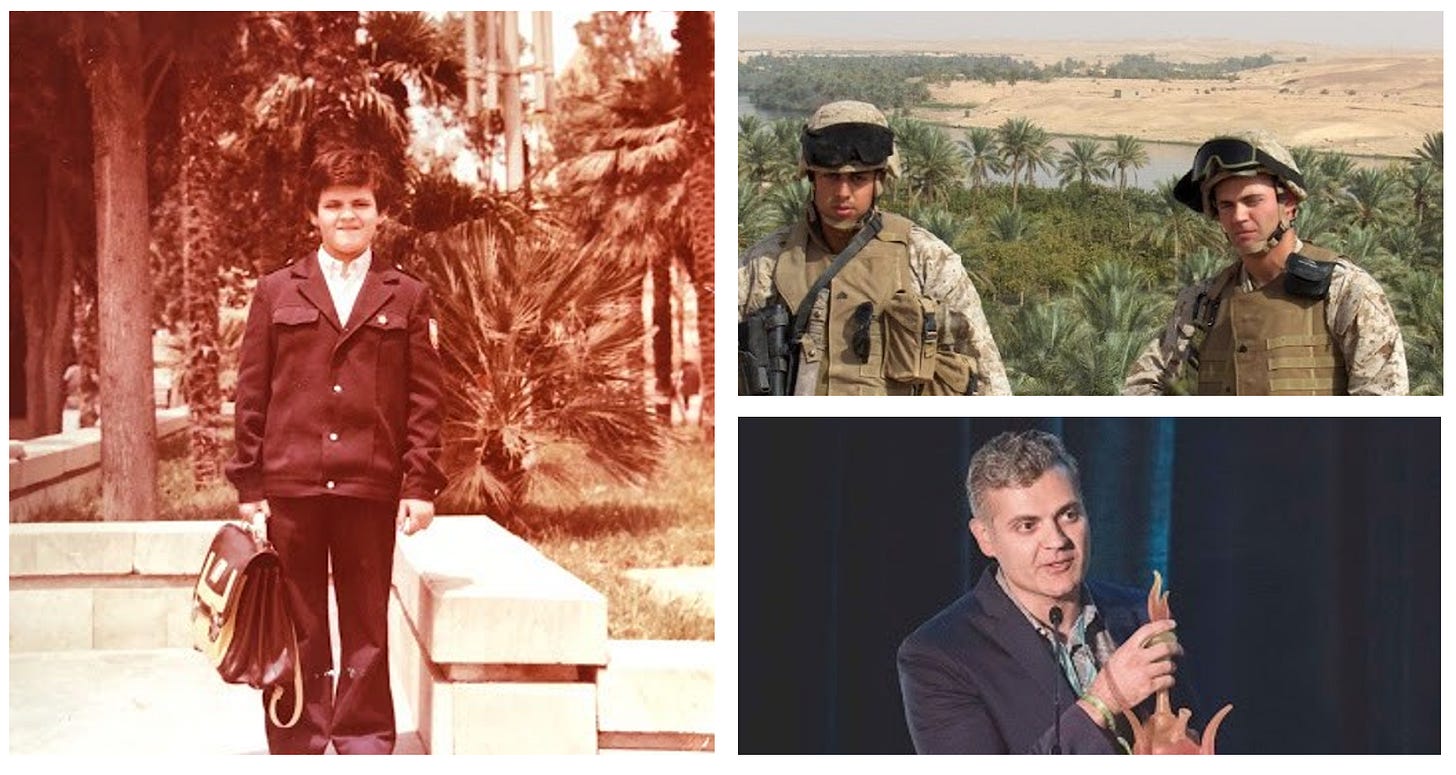

Lamine has an incredibly powerful story. Every founder could have a remarkable journey in their own right, but some are easier to grasp and internalize. Visceral, graphic, inspiring. Lamine’s path from USSR refugee to successful tech founder is one of them. He had to escape Azerbaijan and ended up in Moscow as a kid. For six years, he navigated life as a cash-strapped refugee, starting off in a cramped one-room apartment with a dozen other family members. Eventually, he landed in a semi-permanent spot—a run-down building once used for chemical labs.

Lamine felt, with full rigor, the hardship of economic exclusion. After crossing the borders of 7 different countries, he finally found a home in the US and kick-started his vision, which led to his latest project, StellarFi. Along the way, he did a bunch of impressive things - became a policymaker, sold several of his tech companies, and even joined the US Marines. The American dream at its finest.

I’m not a fan of buzzwords. I still use them daily to sum up ideas and group topics, but I have to admit they often sound empty. It bugs me how they miss the mark on important nuances. “Financial Inclusion” - what a cold phrase... It makes me think of some PR slogan dreamed up by a distant agency in Washington. But stories like Lamine’s snap these concepts back to life, making them warm and genuine and tangible.

But we don’t have to look at Azerbaijan for such circumstances. This is a massive issue here in the US too, where 1 in 3 Americans struggle to pay their bills and can’t afford to take on more debt. ~130mm Americans have credit scores of less than 680 and can’t access credit at affordable rates. They are locked out of opportunities. What’s worse, the FICO score has become a widespread yardstick, not just for assessing creditworthiness but also for deciding if you should be hired or if you’ll get slapped with a more expensive insurance quote. How can we break this cycle? The paradox here is that you need credit to build credit. You literally have to go into debt to prove you’re good for your money. This might force people to take on expensive debt they can’t repay, pushing them into a death spiral that takes them farther and farther from the financial system.

As a US immigrant myself, I had a small taste of this. Unlike most of the population with poor credit, I was in an extremely privileged financial position with a high-earning job at a bank, YET I couldn’t even apply for a credit card, precisely because I had no credit history. Not addressing financial inclusion means, by definition, that people will be excluded from the best deals out there when they actually need them the most. It’s expensive to be poor. This '“FICO score fence” is undermining the very tenets of the American dream: the ideal that every citizen of the US should have an equal opportunity to achieve success through hard work, determination, and initiative.

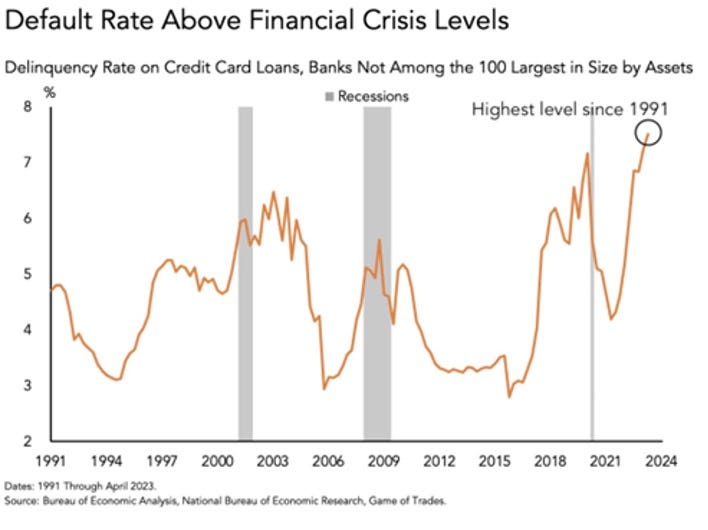

Don’t get me wrong. The FICO score is a really efficient tool to streamline lending decisions, and it’s miles ahead of other economies where credit is almost non-existent. But as we’ve seen, it has clear limitations. Financial inclusion talks will become increasingly relevant as overall consumer savings drop and the economy becomes more fragile. After several years of helicopter money and stimmies, the party has come to an end. Higher interest rates and persistent inflation are, as it happens, taking a toll on the most vulnerable segments of the population. Consumer debt is at an all-time high, and delinquency rates are creeping up.

I asked Lamine if he thinks the average US consumer is basically screwed, for lack of a better term. He thinks they are.

The title of this piece could easily be “The Fico Score AND The American Dream”. Fintechs like StellarFi are an attempt to show consumers the way to succeed by playing within the existing rules. Instead of drowning them in “financial eduaction” articles, they’re following what I like to call the “widgitization of education”. It’s all about integrating user-friendly features in the app that encourage users to take actions that directly impact their FICO score. Learning through widgets; improving through widgets.

The jury is still out on whether StellarFi or other forms of financial and educational innovations will prevail and scale efficiently. But this undoubtedly marks the next wave of Fintech, where innovation truly crosses the chasm to make a positive impact on a larger segment of the population. While StellarFi remains a startup and cannot address every problem at once, it’s a huge step in the right direction. It's already helping thousands of people boost their FICO scores, get back on their feet, and become part of the credit ecosystem that has built America for centuries.

You can listen now on Spotify, Apple or watch the video below.

In this Sobremesa, we chat about:

(00:00) Introducing Lamine Zarrad

(01:00) No money, no documents: life as a USSR refugee

(06:10) From US immigrant to joining the Marines

(08:58) Aiming high: What’s his ambition in life?

(12:01) StellarFi, the next big thing in fintech

(19:14) It's expensive to be poor

(20:57) The history of credit and the FICO score

(26:24) Is the FICO score failing us?

(30:14) A new education path: Widgitization

(33:59) Is the US consumer screwed?

(38:20) The future of fintech

(40:55) Where to find out more